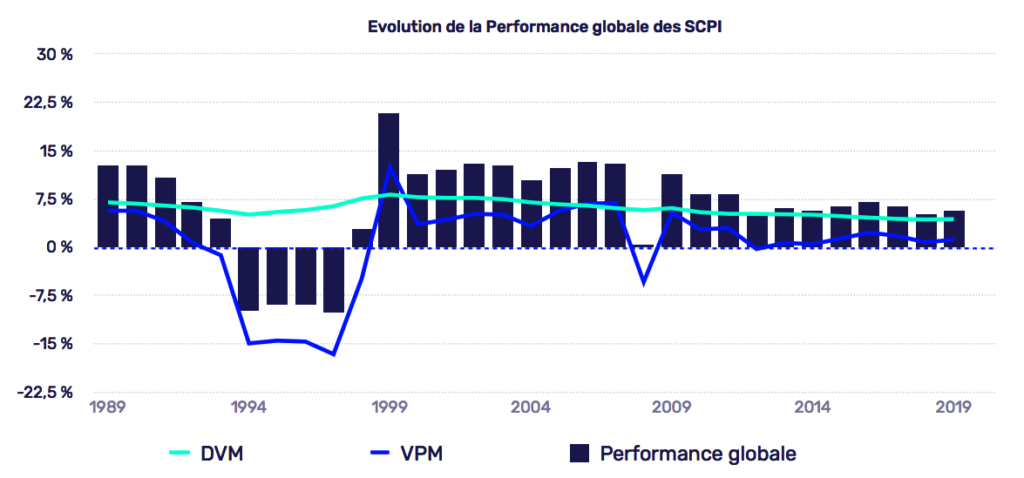

In the unprecedented context created by the coronavirus health crisis which impacted various sectors of the economy, MeilleureSCPI.com and Rock-n-Data carried out a retrospective study on the past performance of performance SCPIs. This aims to understand and analyze the evolution of the overall performance of yield SCPIs over time by distinguishing the variations of the VPM from the fluctuations of the yield distributed by the SCPIs. The main challenge is to identify the periods of growth and crisis of SCPIs over the past decades (between 1989 and 2019) and to explain them by placing them in their economic context.

Remember that the DVM (Market Value Distribution) and the MPV (Average Price Variation) are the two indicators that reflect the direct performance of SCPIs for subscribers. Indeed, the DVM designates the annual return net of management fees of the SCPI (ratio between the dividends paid for the year in full possession and the average buyer price for the year) while the MPV corresponds to the change in the average subscription price of a SCPI unit.

The study tends to show the resilience shown by the SCPI model in going through the Real estate crisis of the 1990s as well as the global financial crisis of 2008 and thus provides us with information on what could happen during the economic crisis that we are currently crossing.

During the 1970s, SCPIs had a long-term “real estate ownership” strategy (buy and hold) and carried out little arbitrage of their investments. They experienced rapid growth in the 1980s thanks to the framework. security measures put in place by the COB (Commission des Opérations de Bourse, former name of the Autorité des Marchés Financiers) and against the background of rising corporate property prices.

It was not until the real estate crisis of 1993 to witness the first disruption in the SCPI market. The VPM will be at its lowest in its history in 1997 in the midst of an unfavorable real estate economy coupled with a liquidity crisis. It was not until 1999 that REITs entered a new phase of growth linked to rising property prices.

The second disruption occurs in 2008 but will be short-lived thanks in particular to an accommodating monetary policy favoring low interest rates, making real estate a safe haven for investors.

The study highlights the fact that it is the particularly low MPVs in these times of crisis that have affected the overall performance of SCPIs and not the returns which have always remained high. Thus, although past performance is no guarantee of future performance, the decline in the overall performance of yield SCPIs over the year 2020 would be due more to a drop in MPV rather than a drop in yield. This is confirmed when we look at the figures for 2020 at the moment which suggest a forecast return of over 4.15% (Rock-N-Data figure) against 4.40% in 2019 while the revaluation seems to be established at 0 3% today, down 95 basis points from last year (1.25%).

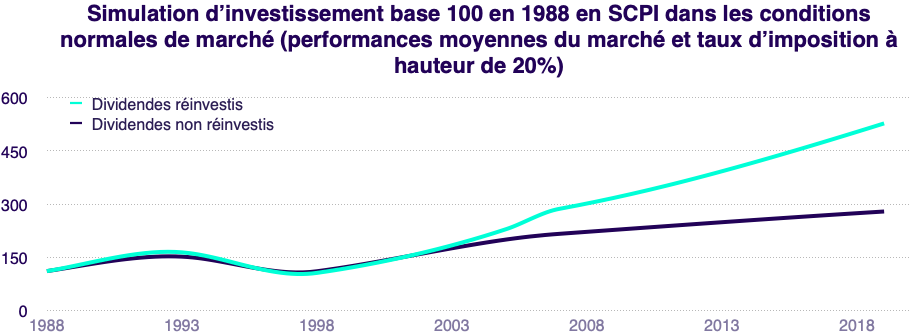

The fact remains that over the past thirty years, our study shows that savers have every interest in keeping their shares in order to grow their capital, even when the real estate and economic situation leads to a drop in performance.

Thus, a saver who has continuously reinvested his dividends for 30 years would have achieved double the profit of a saver who received his dividends each year, thus illustrating the long-term performance of investing in SCPI.

Average market performance obtained by summing the MPV and DVM for each year, taking into account a tax rate of 20% on dividends obtained each year by the saver.

All

All